why is aclu not tax deductible

It is the membership organization and you have to be a member to get your trusty ACLU card. Membership dues and other gifts to the american civil liberties union are not tax deductible.

Our Rights Can T Wait American Civil Liberties Union

While you may think of the ACLU as one giant nonprofit the IRS does not.

. The ACLU is a 501c 4 nonprofit corporation but gifts to it are not tax-deductible. They also enable us to advocate and lobby in legislatures at the. The ACLU is a 501c 4 nonprofit corporation but gifts to it are not tax-deductible.

The main ACLU is a 501c4 which means donations made to it are not tax deductiblethough. While not tax deductible they advance our extensive litigation communications and public education programs. Is the ACLU an organization that falls under charitable donations.

ACLU President Susan Herman joins At Liberty to discuss the organizations historic unanimous vote on impeachment. Making a gift to the ACLU via a wire transfer allows you to have an immediate impact on the fight for civil liberties. It is the membership organization and you have to be a member to get your trusty ACLU card.

Why is donating to the ACLU not tax deductible. The ACLU actually has two arms the lobbying organization and the foundationand particularly if you itemize your taxes it pays to be aware of the difference. Donations to the ACLU are not tax-deductible.

Donations to the ACLU are not tax-deductible because the organization engages in legislative lobbying. This is because donations in support of legislative advocacy supporting specific bills that enhance civil liberties protections or opposing bills that seek to erode them are not tax deductible. Gifts to the ACLUs Guardian of Liberty monthly giving program are not tax deductible.

For more details please email us. The American Civil Liberties Union ACLU is a 501 c 4 a tax. The American Civil Liberties Union Foundation ACLU Foundation is a 501 c 3 a tax-exempt.

The ACLU Foundation is a 501c3 nonprofit which means donations made to it are tax deductible. It is the membership organization and you have to be a member to get your trusty ACLU card. As an organization that is eligible to receive contributions that are tax-deductible by the contributor federal law limits the extent to which the ACLU Foundations may engage in lobbying activities.

The ACLU is a 501 c 4 nonprofit corporation but gifts to it are not tax-deductible. They support our effective citizen-based. You can read all about it on this page of the ACLUs website.

About Issues Our work News Take action Shop Donate. The ACLU is a 501c 4 nonprofit corporation but gifts to it are not tax-deductible. The ACLU is actually two very closely associated institutions the American Civil Liberties Union and the ACLU Foundation.

Make your tax-deductible gift today and help us fight alongside people whose rights are in severe jeopardy. These organizations are not considered to be charitable organizations under the regulations - that section of the Code is 501 c3 - and therefore contributions made to the ACLU are not deductible as charitable contributions. Gifts to the ACLU Foundation on the other hand are deductible because that arm of the organization engages solely in legal representation and communications efforts.

It is the membership organization and you have to be a member to get your trusty ACLU card. ACLU monies fund our legislative lobbyingimportant work that cannot be supported by tax. The ACLU is a 501 c 4 nonprofit corporation but gifts to it are not tax-deductible.

Gifts to the aclu foundation on the other hand are deductible because that arm of the organization engages solely in legal representation and communications efforts. ACLU monies fund our legislative lobbyingimportant work that cannot be supported by tax-deductible funds. It is very very very very hard to get a job at the ACLU.

Back to News Commentary Why the ACLU Called for Trumps Impeachment. As other answers have noted the ACLU proper is a tax-exempt organization per section 501 c4 of the Internal Revenue Code. ACLU monies fund our legislative lobbyingimportant work that cannot be supported by tax-deductible funds.

It is the membership organization and you have to be a member to get your trusty ACLU card. The ACLU is a 501c 4 nonprofit corporation but gifts to it are not tax-deductible. It is the membership organization and you have to be a member to get your trusty ACLU card.

For your donation to be counted as tax-deductible it must. Depending on how you donate your gift may or may not be tax deductible. The american civil liberties union foundation aclu foundation is a 501 c 3 Why isnt aclu tax deductible.

Why is ACLU not deductible. Contributions gifts and dues to the Sierra Club Rochester Area Group are not tax-deductible. Gifts to the ACLU allow us the greatest flexibility in our work.

Thank you for your interest in contributing to The Sierra Club Rochester Area GroupYour gift will help support our efforts to protect our wildlands and wildlife keep our air and water free from pollution and promote a clean energy futureNote. Therefore most of the lobbying activity done by the ACLU and discussed in this Web site is done by the American Civil Liberties Union. Why is ACLU not deductible.

The ACLU is a 501 c 4 nonprofit corporation but gifts to it are not tax-deductible. Donations to the ACLU are not tax deductible while donations the the ACLU Foundation are. ACLU monies fund our legislative lobbyingimportant work that.

ACLU monies fund our legislative lobbying--important work that cannot be supported by tax-deductible funds. It is the membership organization and you have to be a member to get your trusty ACLU card. ACLU monies fund our legislative lobbyingimportant work that.

ACLU monies fund our legislative lobbyingimportant work that cannot be supported by tax-deductible funds. The American Civil Liberties Union ACLU is a 501 c 4 a tax-exempt social welfare organization that engages in political andor lobbying efforts to further its mission which means donations are treated as membership fees and are therefore not tax deductible. Gifts to the ACLU Foundation are fully tax-deductible to the donor.

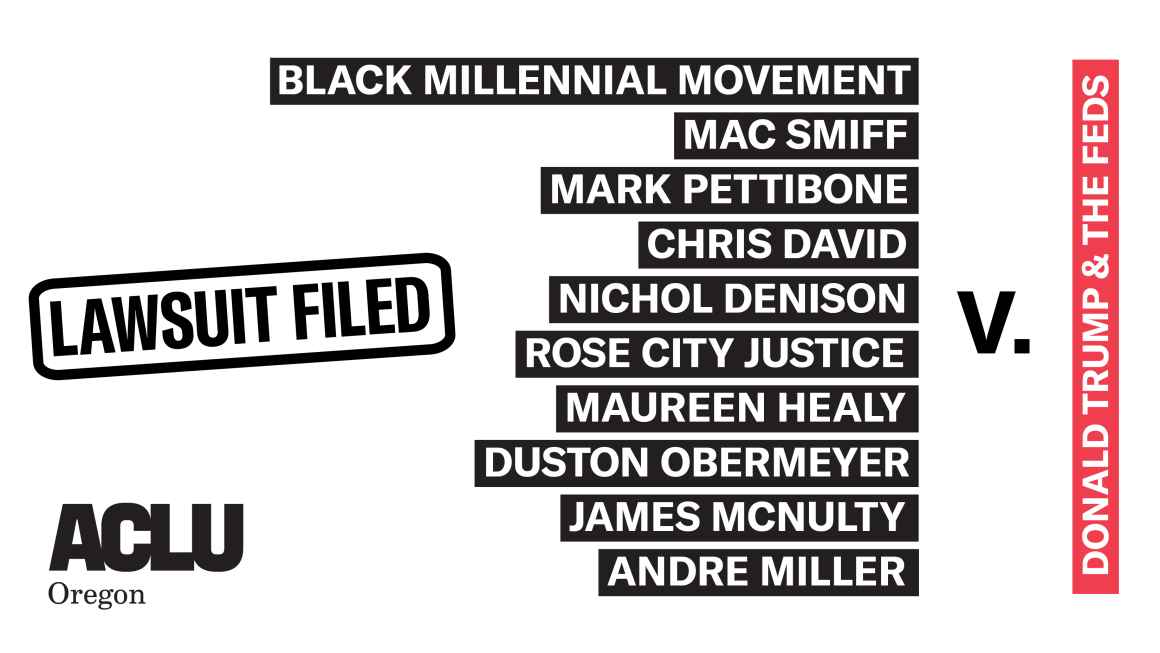

Portland Veterans Abducted Protester Black Activists Sue Trump In Aclu Lawsuit Aclu Of Oregon

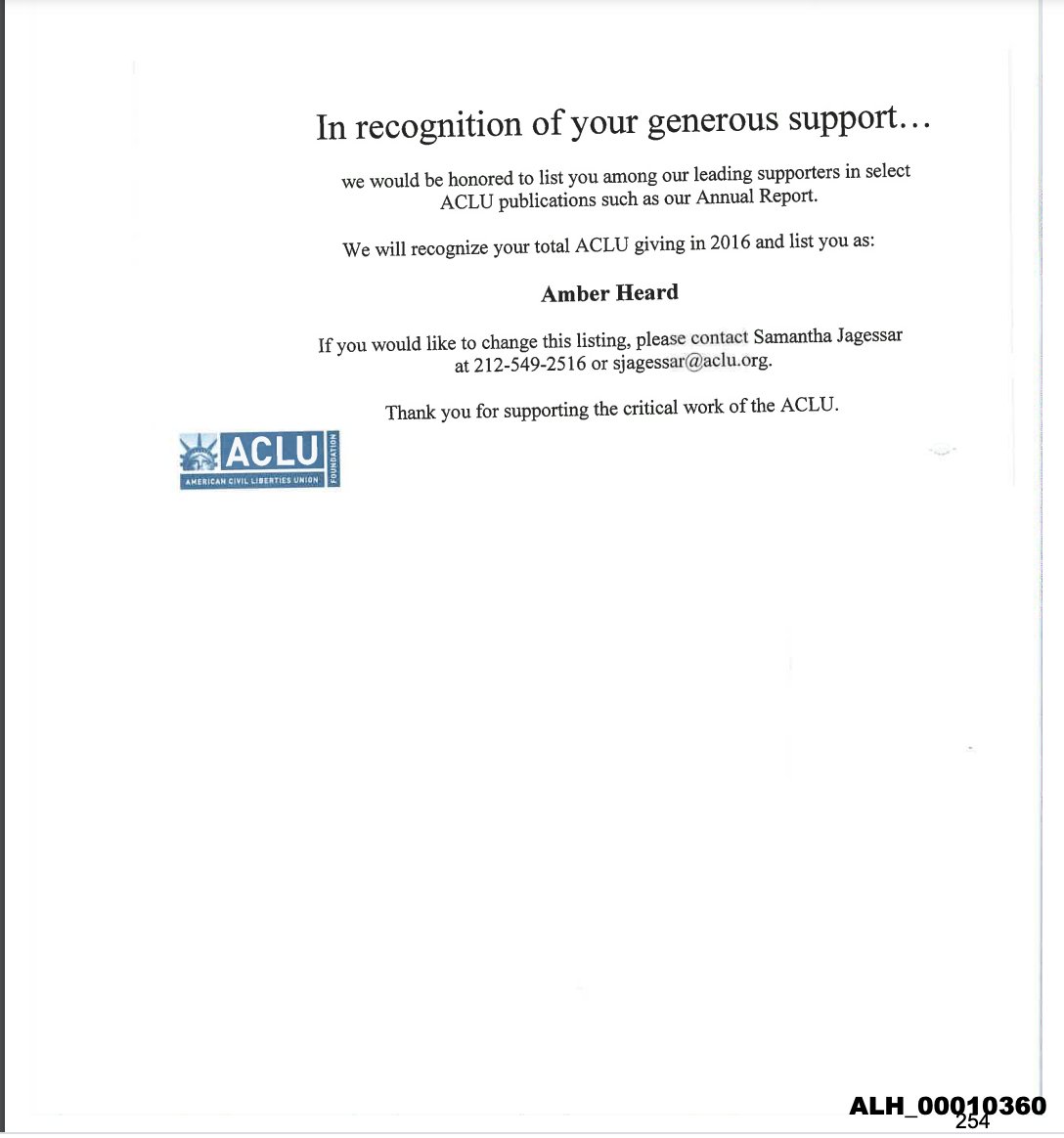

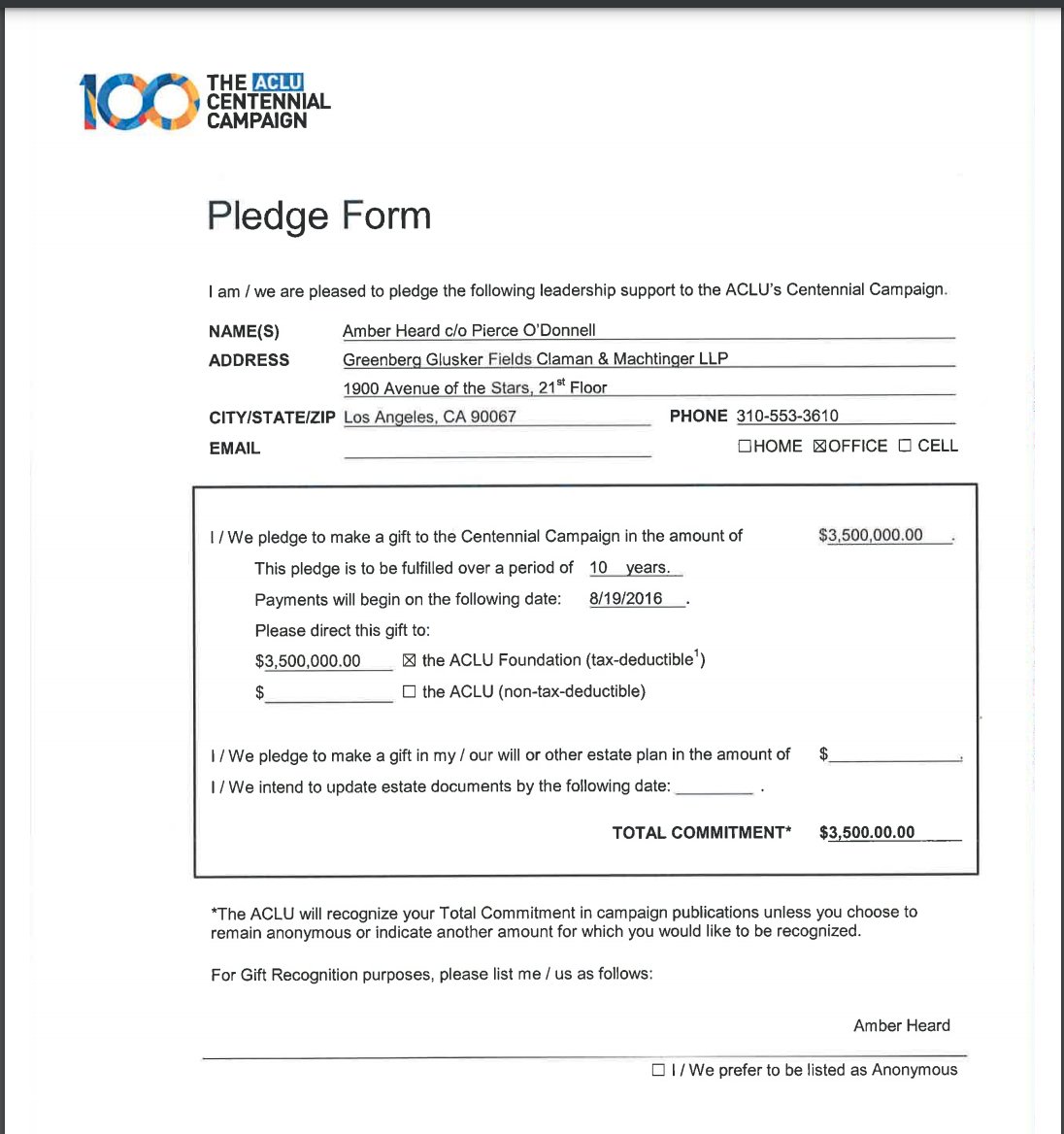

Thereallaurab S Tweet Littlethings226 Great Catch Why Would They Use Their Centential Logo Anytime Before 2019 So That Pledge Form Was Created Probably After The Subpoenas Were Issued In 2020 No Wonder

Pin By Wan M On Politics History Current Events Global Dod In 2021 Family Separation Supportive Make A Donation

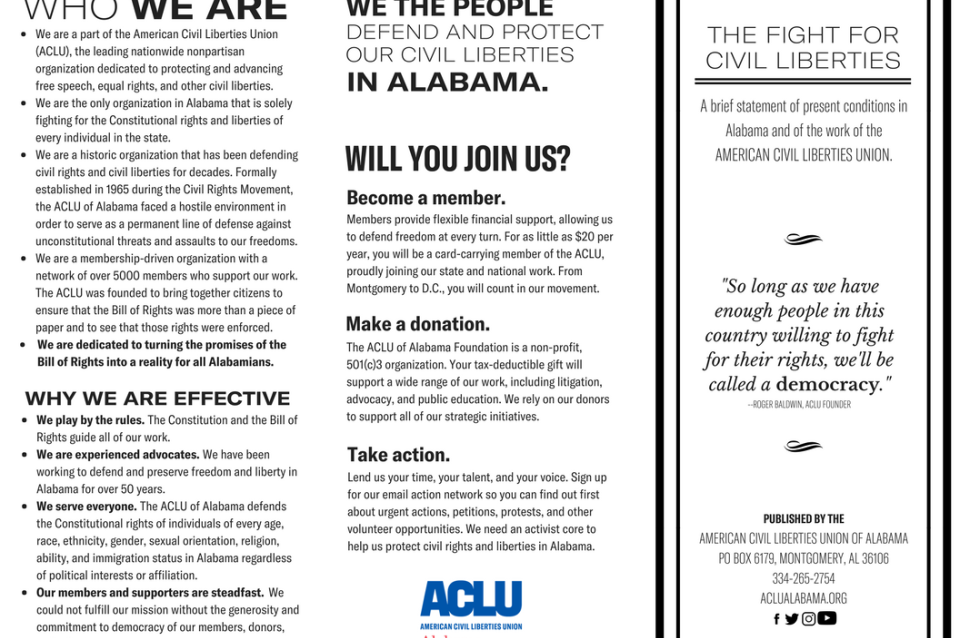

Aclu Of Alabama Quick Facts Aclu Of Alabama

Aclu Of Virginia Home Facebook

Thereallaurab S Tweet Littlethings226 Great Catch Why Would They Use Their Centential Logo Anytime Before 2019 So That Pledge Form Was Created Probably After The Subpoenas Were Issued In 2020 No Wonder

Aclu Donations How To Make A Tax Deductible Gift Money

Inchhighpi S Tweet There S The Aclu Foundation Aclu Ah Gave To The Foundation That Accepts Donor Advised Funds Vanguard It S Tax Deductible Aclu Only Is Non Tax Deductible Ah Got 7

Thereallaurab S Tweet Littlethings226 Great Catch Why Would They Use Their Centential Logo Anytime Before 2019 So That Pledge Form Was Created Probably After The Subpoenas Were Issued In 2020 No Wonder

Fuel Our 2022 Action Fund American Civil Liberties Union

Aclu Testimony Prairie Village Ks Non Discrimination Ordinance Aclu Of Kansas

2017 Year In Review Aclu Of Connecticut

Update Your Monthly Commitment To The Aclu American Civil Liberties Union

Is Our Democracy At Risk Answer Question In Flagler Volusia Aclu Essay Contest 850 In Prize Money Flaglerlive